Solusius has developed the Treasury Legal Scan to quickly review the main legal terms of the finance agreements of a company and its subsidiaries. If a company has entered into a Revolving Credit Facility or Senior Facilities Agreement, the company has to provide a compliance certificate periodically. Such compliance certificate cannot be executed if the company or its subsidiaries are in default under other finance agreements (and the financial indebtedness outstanding under such agreements exceeds the cross default threshold in the Revolving Credit Facility or Senior Facilities Agreement). The Treasury Legal Scan identifies the main risks of the occurrence of such event of default and possible improvements in non-financial terms. During the Treasury Legal Scan Solusius typically reviews a Revolving Credit Facility or Senior Facilities Agreement, bilateral loan agreements, overdraft facilities, main cash management agreements and ISDA Agreements. Solusius can generally complete the Treasury Legal Scan, including a meeting to discuss the findings, in three days.

Read More

As standard element of a Revolving Credit Facility or Senior Facilities Agreement (hereafter ‘Facility Agreement’) is the obligation of the company to periodically provide a compliance certificate. Typically, the compliance certificate sets out details of financial covenants contained in the Facility Agreement as at a certain date or for a certain period. Furthermore, the borrower confirms in such compliance certificate that it has complied with the financial covenants and that no event of default has occurred.

An event of default occurs when the borrower has not complied with its obligations under the Facility Agreement or if an event happens that has been specified in the event of default section of the Facility Agreement. These events always include misrepresentation, insolvency and cross default provisions. Under Dutch law, the borrower has a duty to investigate whether an event of default has occurred before it can execute the compliance certificate. For most of the events of defaults this would not be an issue, e.g. the borrower knows whether it has complied with its information and payment obligations and whether it is bankrupt. However, for certain obligations, the borrower needs to check the content of other finance arrangement in order to be able to provide the compliance certificate. Also finance agreements entered into by its majority owned subsidiaries have to be checked, as several covenants and events of default in the Facility Agreement also relate to finance agreements these subsidiaries have entered into.

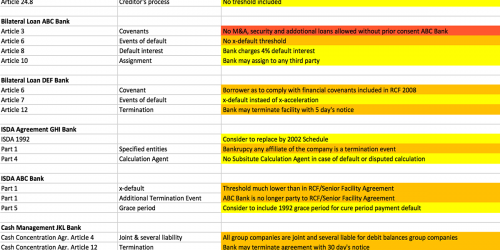

Usually finance agreements like bilateral loans, cash management agreements and ISDA Agreements are only periodically reviewed and many tend to be in place for many years without any review. For instance, when an extension of a loan agreement takes place, often only financial aspects are discussed and the other clauses are not discussed. As a result, clauses in finance agreements are often not fully aligned and/or could conflict with the Facility Agreement. The experience of Solusius learns that approximately 20{a2f7917adf4ca18c26de88da2b694dfb1faac7951024115e51c81edebd9e5e02} of finance agreements that are in place for some time contain clauses that either constitute an event of default under the Facility Agreement or result in an increased risk thereof.